tax loss harvesting wash sale

The wash sale rule IRC 1091 prohibits investors from recognizing a capital loss on a security when it is replaced by a substantially identical security within 30 days before or after the sale which means that whichever investment replaces the one that was sold to capture the loss. Because your 800 loss is disallowed due to a wash sale the disallowed loss is then added to the price of your new shares to determine your cost basis for the new shares.

Tax Loss Harvesting Definition Example How It Works

A wash sale is one of the key pitfalls to avoid when trying to take advantage of tax-loss harvesting to reduce your taxes and in falling markets such as in 2022 it can be valuable to make sure.

. Wash sale rules apply to a number of. The loss is typically disallowed or deferred for federal income tax purposes. The Stock Purchase.

On Friday August 5. The key to proper tax-loss harvesting comes down to facts and circumstances. Under the wash-sale rule intended to prevent gaming the system for tax benefits an investor has to wait at least 30 days to.

The wash-sale rule dictates when a tax loss can be harvested. The Wash Sale Rule. If you sell Total Stock Market with losses and buy back the same fund within 30 days before or after the sale that would be called a wash sale and you cannot claim the losses on your tax return.

To avoid a wash sale one approach is to trade the depreciated asset for a coin with which its price is closely correlated. The easiest rule to screw up tax-loss harvesting is the wash sale rule. Therefore the business loss and the capital loss sustained by the decedent for the period ending with the date of his death are deductible only on his final income tax return.

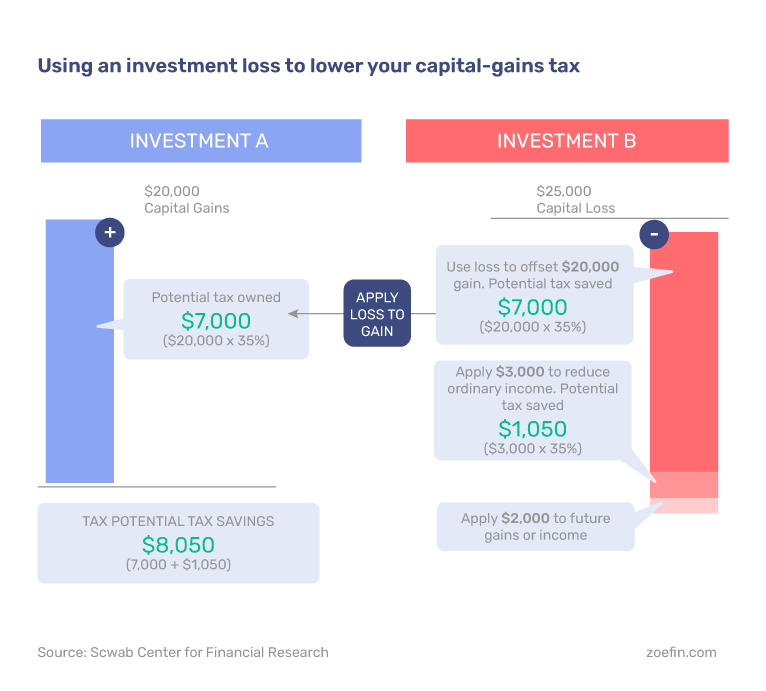

Tax gainloss harvesting is a strategy of selling securities at a loss to offset a capital gains tax liability. 400 800. The wash-sale rule is an IRS regulation that prohibits investors from using a capital loss for tax-loss harvesting if the identical security a substantially identical security or an option.

A wash sale occurs when you sell. The opposite of a realized gain or loss Wash Sale. A wash sale occurs when you sell or trade stock or securities at a loss and within 30 days of the sale either before or after you purchase the sameor a substantially identicalinvestment.

If you rebuy a crypto asset after the 30 day period passes your actions no longer classify as wash sale trading. Understanding the Wash Sale Rules On Tax Loss Harvesting TLH The so-called wash sale rules are one of the oldest anti-abuse provisions of the Internal Revenue Code first originating with the Revenue Act of 1921 and substantively codified in the current IRC Section 1091 as a part of the general overhaul in developing the Internal Revenue Code of 1954. But you need to familiarize yourself with the wash sale rule which blocks you from.

Capital Gains Tax. United States 354 F. This rule prohibits you from selling an investment to book a capital loss to reduce your tax bill and immediately repurchasing it.

The benefits and mechanics of automated tax-loss harvesting and rebalancing. In a down market you may consider tax-loss harvesting which can turn portfolio losses into tax breaks. 2d 202 10th Cir.

The wash sale rule is designed to prevent taxpayers from claiming deductible losses on securities if they acquire a substantially identical position in that security within 30 days. Tax loss harvesting is an investing strategy that can turn a portion of your investment losses into tax offsets helping turn financial losses into wins. The definition of a wash sale is a bit more complicated than that.

An Example of Tax-Loss Harvesting. Tax-loss harvesting involves intentionally selling a security and taking a loss that is then used to offset a gain come tax time either within the same portfolio or elsewhere. Add to the list a relative newcomer tax-loss harvesting.

Specifically when you sell a security at a loss you cannot purchase one that is substantially identical to replace it within 30 days. And potential penalties should an IRS audit classify a transaction as a wash sale. Wash-sale rules say that if you bought and sold the same security for a loss within a 30-day period you cant use the loss to offset gains on your tax return.

It is typically used to limit the recognition of short-term capital gains which are. Under the wash-sale rule intended to prevent gaming the system for tax benefits an investor has to wait at least 30 days to repurchase the same stock or. If you buy the same investment or any investment the IRS considers substantially identical within 30 days before or after you sold at a loss the loss will be disallowed.

One of the most important rules surrounding tax-loss harvesting is the wash sale rule. That means you cant turn around and buy the same security in the 30 days after you sell itif you do the basis is reset and that loss you were trying to get is washed away. There are safer ways to harvest losses on a crypto asset.

Fine points about tax loss harvesting Regulatory. But with tax-loss harvesting all things are not equal. The wash-sale rule states that your tax write-off will be disallowed if you buy the same security a contract or option to buy the security or a substantially identical security within 30 days before or after the date you sold the loss-generating investment.

Thus no part of such net operating loss or capital loss is deductible by the decedents estate or carried. Watch out for the wash sale rule The IRS wont allow you to sell an investment at a loss and then immediately repurchase it known as a wash sale and still claim the loss. Thus to use tax-loss.

See Calvin v. When an investor sells an investment at a capital loss and repurchases the same security or a substantially similar one. Use tax-loss harvesting to take advantage of capital losses eligible portfolios proactively sell underperforming investments and replace it with a similar position.

The wash sale rule prohibits an investor from taking a tax deduction if they sell an investment at a loss and repurchase the same investment or a substantially identical one within 30 days. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price. Safer crypto tax loss harvesting.

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Do S And Don Ts Of Tax Loss Harvesting Zoe

What Is Tax Loss Harvesting Ticker Tape

Year Round Tax Loss Harvesting Benefits Onebite

Tax Loss Harvesting And Wash Sales Seeking Alpha

Tax Loss Harvesting Napkin Finance

Top 5 Tax Loss Harvesting Tips Physician On Fire

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Napkin Finance

Tax Loss Harvesting How To Reap The Most Rewards Diligent Dollar

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Tax Loss Harvesting Flowchart Bogleheads Org

Tax Loss Harvesting Should Investors Believe The Hype Cfa Institute Enterprising Investor

Top 5 Tax Loss Harvesting Tips Physician On Fire

Wash Sale Rule What It Is And How To Avoid

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital